Average paycheck tax

Use this tool to. However they dont include all taxes related to payroll.

Tax Refunds In America And Their Hidden Cost 2020 Edition

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. FICA taxes consist of Social Security and Medicare taxes. The joint returns showed the Stefanowskis paid federal taxes of 178 million on adjusted gross income of 73 million in 2019. In the previous tax year you received a refund of all federal income tax withheld from your paycheck because you had zero tax liability.

Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. For a single filer the first 9875 you earn is taxed at 10. The current rate for Medicare is 145 for the.

Total income taxes paid. Total income taxes paid. Your household income location filing status and number of personal.

Lawmakers have considered introducing a state income tax in recent years but no attempt has been successful thus far. 549 million on an AGI of 1525 million in. While local sales taxes in Seattle Tacoma and some other metro.

Amount taken out of an average biweekly paycheck. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both. Only the very last 1475 you earned.

However that figure is an average and is higher than. As the employer you are required to withhold and pay the amount your employee is responsible for from their paycheck and remit those funds on their behalf. GOBankingRates in order to find how much you take home from the average salary in each state sourced both the federal and state tax brackets from the Tax.

549 million on an AGI of 1525 million in. The bracket you land in depends on a variety of. The total bill would be about 6800 about 14 of your taxable income even.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. The tax brackets in Montana are the same for all filers regardless of filing status. This year you expect to receive a refund of all.

It can also be used to help fill steps 3 and 4 of a W-4 form. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. Payroll Tax Rates.

The first 3100 you earn in taxable income is taxed at 100. How It Works. The current tax rate for Social Security is 62 for the employer and 62 for the employee for a total of 124.

The joint returns showed the Stefanowskis paid federal taxes of 178 million on adjusted gross income of 73 million in 2019. You pay the tax on only the first 147000 of your. See how your refund take-home pay or tax due are affected by withholding amount.

FICA taxes are commonly called the payroll tax. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. The Social Security tax is 62 percent of your total pay until you reach an annual.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The average federal income tax payment in 2018 was 15322 according to the most recent data available from the IRS. Estimate your federal income tax withholding.

2 days agoThe joint returns showed the Stefanowskis paid federal taxes of 178 million on adjusted gross income of 73 million in 2019. The rate jumps to 200 on income above 3100. Payroll tax percentage is 153 of an employees gross taxable wages.

549 million on an AGI of 1525 million in. And then youd pay 22 on the rest because some of your 50000 of taxable income falls into the 22 tax bracket.

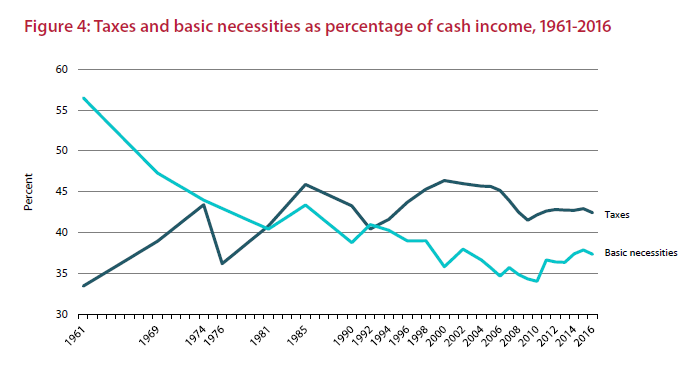

The Measure Of A Plan

Understanding Your Paycheck Credit Com

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

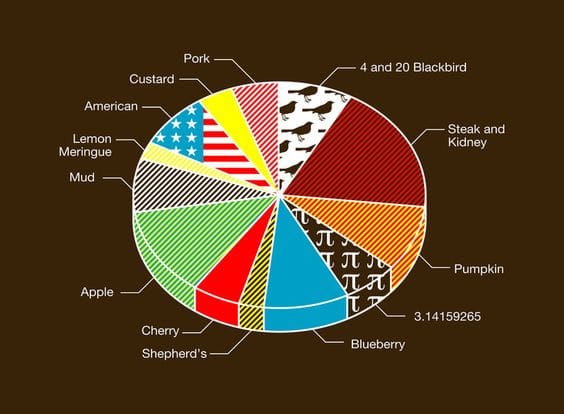

Mathematics For Work And Everyday Life

What Is Casdi Employer Guide To California State Disability Insurance Gusto

The Measure Of A Plan

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

In 2018 The Average Family Paid More To Hospitals Than To The Federal Government In Taxes

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Average Canadians Pay 42 5 Per Cent Of Their Income In Taxes Report National Globalnews Ca

2022 Federal State Payroll Tax Rates For Employers

How Does A Paycheck Look Like In Canada What Are The Deductions Quora